Tips for managing travel expenses?

Mastering Travel Expenses in 2025: The Ultimate Guide to Tracking, Budgeting, and Saving

Let’s be honest: nobody returns from a trip excited to organize a pile of crumpled receipts.

Whether you are a solo freelancer managing your own runway or a corporate manager overseeing a team, the cost of travel is climbing. In fact, if you’re planning a business trip to New York City this year, hold onto your wallet—costs there have skyrocketed to an average of $799 per day according to Hotel Tech Report’s 2024 Business Travel Statistics.

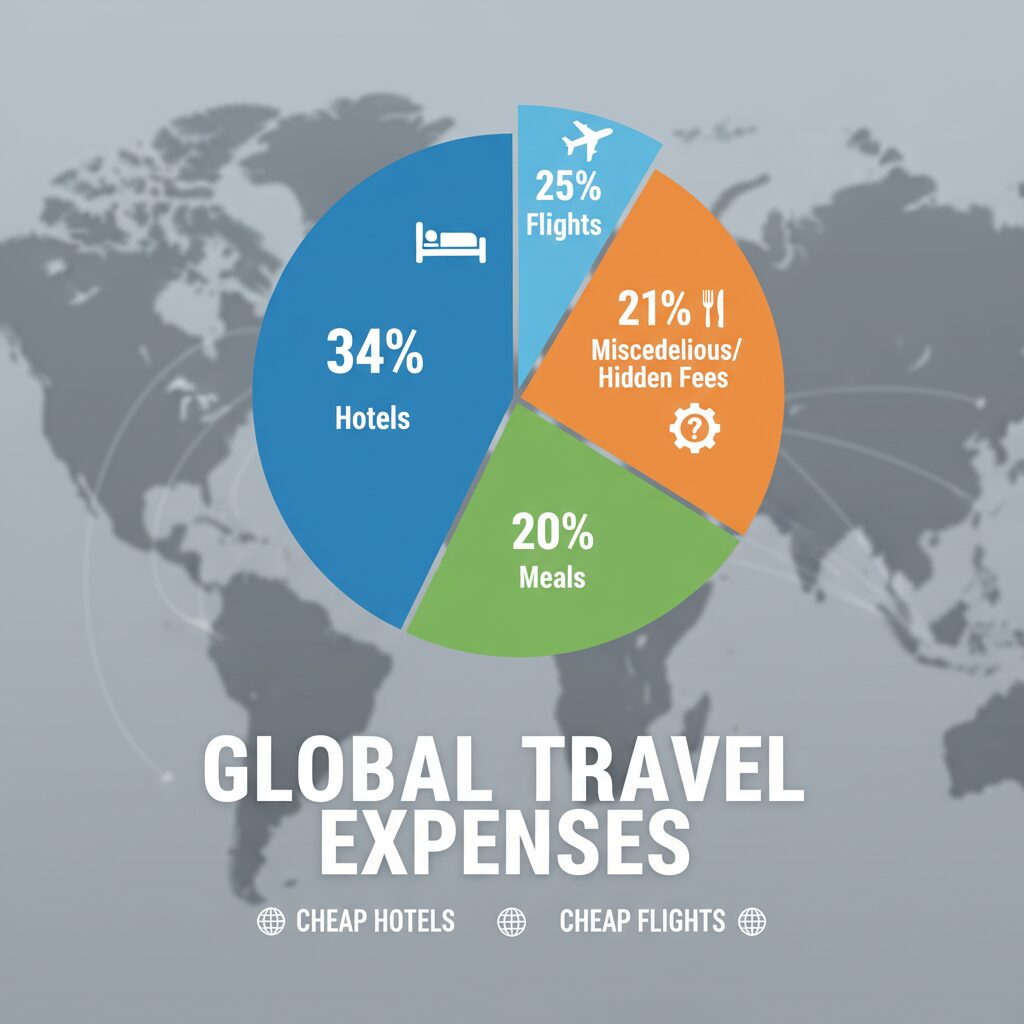

But the real problem isn’t just the obvious costs like flights and hotels. It’s the “leakage.” It’s the foreign transaction fees, the accidental personal spend mixed with business, and the inflation hitting your meal budget. Managing travel expenses in 2025 requires more than just a spreadsheet; it requires a strategy.

According to SAP Concur’s 2024 Business Spending Trends, the average transaction cost for “miscellaneous” travel expenses has jumped by 47% since 2019. If you aren’t tracking the small stuff, you are bleeding money.

In my decade of working with digital nomads and small business owners, I’ve seen terrible expense management sink budgets and trigger tax audits. But I’ve also seen how the right tech stack can automate 90% of the work. Here is your definitive guide to stopping the financial bleeding and mastering your travel spend.

1. Pre-Trip Strategy: Building a Bulletproof Budget

Most people fail at managing travel expenses before they even pack their suitcase. They budget for the flight and the hotel, and then they “wing it” for everything else. In 2025, that approach is a recipe for disaster.

The “Total Trip Cost” Formula

You need to move beyond base rates. With airline capacity constraints continuing to push prices up—business class fares in North America alone are projected to rise 2.7% according to the Amex GBT Air Monitor 2025—you need a more granular approach.

I recommend using the “Total Trip Cost” formula:

- Base Transport: Flights + Baggage Fees (often hidden)

- Accommodation: Room Rate + City Taxes (In Europe, this can be €5-10/night)

- Transfers: Uber/Train to/from airports (Budget $100 minimum roundtrip)

- Per Diem: Meals + Incidentals

- Buffer: +15% for currency fluctuation and emergencies

Accurate Per Diem Estimates

Don’t guess what dinner costs in London. Use data. For US travel, I always refer clients to the GSA rates. For international travel, the State Department rates are the gold standard.

Est. Daily Spend Calculator (Simple)

2. The 2025 Travel Tech Stack: Tools That Work

If you are still stuffing paper receipts into an envelope, stop. The technology has evolved to the point where AI can do the heavy lifting for you.

Here is my breakdown of the best tools based on your specific needs:

| Traveler Type | Recommended Tool | Why It Wins |

|---|---|---|

| Solo/Freelancer | TravelSpend | Best offline mode. Perfect for tracking cash spending in remote areas without data. |

| Group Trips | Splitwise | Handles complex “who owes who” math effortlessly. Essential for shared Airbnbs. |

| Small Business | Expensify | Solid receipt scanning and integration with QuickBooks/Xero. |

| Enterprise | Navan | According to a Forrester Consulting study for Navan, companies using AI-driven platforms see a 16% annual saving on travel costs. |

60% of business travelers now extend trips for leisure (Deloitte 2024 Corporate Travel Study). If you do this, use an app that allows “Tagging.” Tag business meals as #Work and weekend drinks as #Personal instantly. Don’t wait until you get home to separate them; you will forget.

3. During the Trip: Managing Cash Flow & Receipts

This is where the chaos usually happens. You grab a coffee, stuff the receipt in your pocket, and lose it. Or worse, you use the wrong card and get hit with fees.

The “One-Touch” Rule

I live by a simple rule: Never put a physical receipt in your pocket.

The moment a waiter hands you a receipt, snap a photo of it using your expense app immediately. Then, throw the paper away (unless your specific country requires physical copies for VAT, like some parts of Europe). Digitizing immediately stops the backlog from building up.

The DCC Trap: Paying in Local Currency

This is a hill I will die on. When you pay with a credit card abroad, the machine will often ask: “Pay in USD or EUR?”

Always choose the local currency (EUR, GBP, JPY).

If you choose USD, you are opting into “Dynamic Currency Conversion” (DCC). The merchant’s bank sets the exchange rate, which is usually terrible—often 5-7% worse than the market rate. Let your own bank handle the conversion.

4. Post-Trip: Reconciliation and Analysis

You’re back home. Now comes the audit. If you used the “One-Touch” rule, this should be easy. But there are two major areas where people leave money on the table.

VAT Recovery: The Forgotten 20%

If you are traveling to Europe for business, Value Added Tax (VAT) can be anywhere from 10% to 25% of your expenses. Many business travelers forget that this is often recoverable.

According to SAP Concur, billions go unclaimed annually. If you are a registered business, keep those hotel and transport invoices. Services like VAT IT can help you reclaim this money, which can offset a significant chunk of your trip cost.

The “Leakage” Audit

Look at your actual spend versus your budget. Where did you go over? Usually, it’s not the flight price—it’s the ancillary costs. Did you spend $50 on Wi-Fi? Did you pay for breakfast at the hotel ($30) instead of grabbing a coffee outside ($5)?

Use this data to adjust your budget for the next trip. If you consistently overspend on transport, increase that line item next time rather than stressing about it.

5. Advanced Tips for Corporate Managers

If you are managing a team, the game changes. You aren’t just tracking receipts; you’re managing behavior.

Address the “15-20% Error Rate”

Expense fraud sounds malicious, but often it’s just confusion. Data from SAP Concur’s 2024 analysis suggests that approximately 15-20% of expense reports contain non-compliant spend. Most of this is accidental—duplicate submissions or expensing non-covered items.

The Solution: Switch to corporate cards with pre-set controls (like Brex or Ramp). These cards can block transactions at unauthorized merchant categories (e.g., casinos or luxury retail) before they even happen.

Be aware of generational differences. A 2025 report from Berkshire Hathaway Travel Protection notes that Gen Z travelers spend significantly more, averaging over $11,000 annually on trips. They prioritize experiences and convenience. Your policy needs to be flexible enough to accommodate this while maintaining control.

Frequently Asked Questions

How do I keep track of expenses while traveling without internet?

This is a common issue for international travelers. I recommend using TravelSpend or the offline mode in Expensify. These apps allow you to log expenses and snap photos of receipts while offline. Once you reconnect to Wi-Fi, the app syncs everything to the cloud automatically.

What is a reasonable daily budget for business travel in 2025?

It depends heavily on the location. As mentioned, New York City averages $799/day, while a city like Atlanta might be half that. For a general baseline, GBTA data suggests budgeting at least $400-$500 per day for major Western hubs when factoring in hotel, meals, and local transport.

Are travel expenses tax deductible?

Generally, yes, but the rules are strict. In the US, transportation (flights, trains) is usually 100% deductible. Meals are often only 50% deductible unless specific conditions are met. Note: I am a writer, not a CPA. Always consult a tax professional for your specific business situation.

How do I avoid foreign transaction fees?

The easiest way is to use a credit card that waives them specifically. Cards like the Chase Sapphire Preferred, Capital One Venture, or the Wise multi-currency debit card are excellent tools. Standard bank cards can charge up to 3% on every swipe, which adds up fast on a $2,000 trip.

Conclusion: The Digital-First Mindset

Managing travel expenses doesn’t have to be the bane of your existence. The days of taping receipts to a sheet of paper are over.

By adopting a “digital-first” mindset—capturing data instantly, using the right apps, and understanding the hidden costs of modern travel—you can save hours of administrative time and thousands of dollars.

Remember the golden rule of 2025: If it’s not digital, it didn’t happen. Start treating your travel spend with the same rigor you treat your business revenue, and you’ll turn a cost center into a strategic advantage.

Disclaimer: This article provides general financial information and strategies for educational purposes. It does not constitute professional accounting or tax advice. Please consult with a qualified financial advisor regarding your specific circumstances.