How to track travel spending easily?

How to Track Travel Spending Easily: The 2025 Guide to Controlling Trip Costs

In Brief: In 2024-2025, travel costs are surging—driven by a 7% rise in average trip prices and a 12% jump in experience spending. This guide replaces outdated “spreadsheet advice” with a modern “Hybrid Tracking Method” using fintech automation and behavioral psychology to handle hidden taxes, record-high ATM fees, and multi-currency chaos.

Let’s be honest: looking at your bank account after a trip usually induces a specific type of nausea. You budgeted for the flight and the hotel, but somehow, the money just… vanished.

You aren’t imagining it, and you certainly aren’t alone. In my years covering travel finance, I’ve watched the landscape shift from simple budgeting to complex financial gymnastics. The stakes have never been higher. According to Squaremouth data, the average cost of a summer trip jumped 7% in 2024, hitting nearly $10,000 for the first time.

Tracking your spending in 2025 isn’t just about being frugal; it’s about survival in an era of “skimpflation” (paying more for less) and aggressive new tourist taxes. If you’re still relying on a crumpled wad of receipts or a basic Excel sheet, you’re already behind. Here is how to track travel spending easily, using the systems that actual frequent flyers use.

Why Your Trip Budget Fails (The Hidden Costs of 2025)

Before we fix the system, we have to understand the leak. Most travelers fail to track spending not because they are lazy, but because the variables have changed. The “coffee and sandwich” budget of 2019 doesn’t apply when inflation and hidden fees eat 15% of your funds before you even take a bite.

The “Invisible” Inflation of Experiences

We are living in the age of the “Travel Maximizer.” We value memories over merchandise, but that shift comes with a price tag. According to the Mastercard Economics Institute’s 2024 Travel Trends report, spending on experiences (nightlife, activities, events) has surged to 12% of tourism sales—the highest point in five years.

When I analyze my own recent trips, it’s never the hotel that breaks the budget—it’s the spontaneous “once-in-a-lifetime” tours. Tracking these variable costs requires a system that is as fast as your decision to book that sunset cruise.

The New Wave of Tourist Taxes

If you are heading to Europe or Asia in 2025, your spreadsheet is likely missing a crucial column: the entry fee. Governments are combatting overtourism with fiscal barriers:

- Venice: The access fee is €5, but Visit Ukraine and official tourism boards confirm this will apply to twice as many days in 2025, potentially rising to €10 on peak days.

- Bali: As of February 2024, all inbound foreign tourists pay a levy of 150,000 rupiah (~$9.60 USD), according to Travel Market Report.

- Amsterdam: The city raised its accommodation tax to 12.5% of the room cost, making it one of the highest in Europe.

These aren’t “spending” in the traditional sense, but they are mandatory costs that often get lost in the tracking shuffle, leading to a budget deficit on day one.

Method 1: The “Digital Wallet” Ecosystem (Best for Automation)

The easiest way to track spending is to stop doing it manually. If you are physically typing “Lunch – $15” into your phone, friction will eventually win, and you will stop tracking.

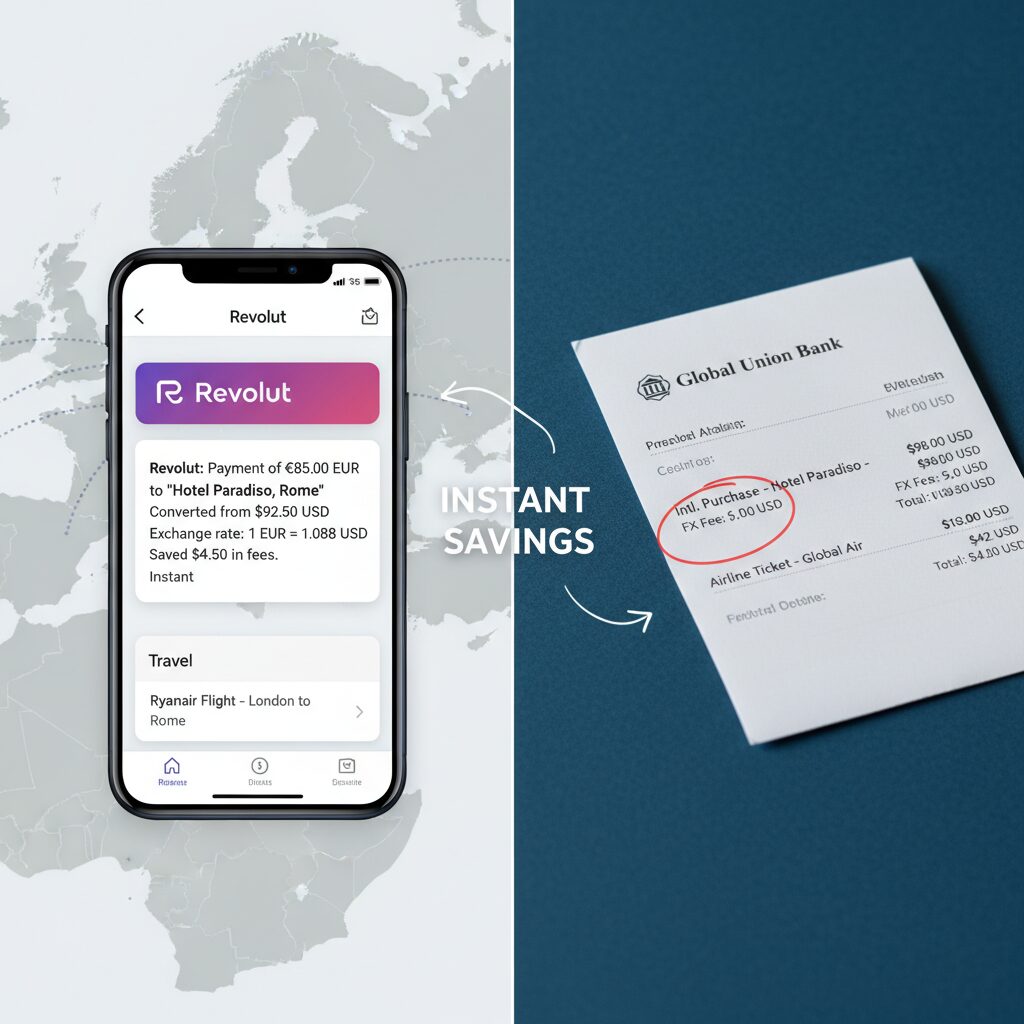

In 2025, the gold standard is the Fintech Ecosystem—specifically using cards like Revolut or Wise. I switched to this method three years ago, and it changed everything.

The “Ping” Psychology

When you use a standard credit card abroad, the transaction might show up days later, often with a confusing exchange rate adjustment. With a dedicated travel card, you get an instant notification on your phone in your home currency.

This psychological reinforcement is critical. It closes the loop between “swipe” and “consequence.” Moreover, these apps categorize spending automatically. You don’t need to tell the app you bought a train ticket; it knows.

Avoiding the ATM Fee Trap

One of the biggest budget leaks is the ATM fee. According to Bankrate’s 2024 study, the average out-of-network ATM fee hit a record high of $4.77. In high-fee countries like Turkey (3.59%) or Iceland (4.60%), as reported by Wise, drawing cash is expensive.

The Strategy: Use your digital wallet app to find “partner” ATMs or fee-free limits. If you must use cash, withdraw a lump sum (e.g., $200) and log it in your tracker immediately as “Cash Allowance.” Don’t try to track every cash coffee; just track the withdrawal.

Method 2: Dedicated Expense Apps (Best for Detail)

For the “Maximinzers” who want granular detail—or those dealing with the nightmare of group math—a dedicated app is non-negotiable.

Top Solo Tracker: TravelSpend

While many apps exist, TravelSpend (or its competitor Trabee Pocket) reigns supreme for one reason: the “In My Pocket” feature. You set a total budget, and the app tells you exactly how much you can spend per day for the rest of the trip. If you overspend today, tomorrow’s daily limit drops automatically.

The Group Travel Savior: Splitwise vs. Batch

Nothing destroys a friendship faster than arguing over who paid for the tapas.

- Splitwise: Remains the heavy hitter for debt simplification. It handles multi-currency inputs flawlessly (e.g., I paid in Euros, you pay me back in Dollars).

- Batch: Better for the planning phase and party trips, integrating itineraries with costs.

This old wisdom holds up. The $3 gelato doesn’t feel like much, but on a 10-day trip with a partner, three small treats a day equals nearly $200. Apps catch these leaks.

Comparison: Best Travel Tracker Apps 2025

| App Name | Best For | Cost | Key Feature |

|---|---|---|---|

| TravelSpend | Solo / Couples | Free / Premium ($) | “Daily Budget” adjustment logic |

| Splitwise | Groups | Free | Debt simplification (Who owes who) |

| Revolut | Automation | Free | Auto-categorization & Zero FX fees |

| Expensify | Business | Free / Sub | Smart receipt scanning |

Method 3: The “Hybrid Envelope” System (For the Disciplined)

Maybe you don’t trust apps, or you’re traveling somewhere cash-heavy like Japan or Germany. The “Hybrid Envelope” system is a modern twist on the old cash-stuffing method.

Digital Envelopes

Apps like Wise and Revolut allow you to create “Vaults” or “Jars.” I create a vault specifically for “Dining” and one for “Transport.” I move money from my main balance into these vaults. When the Dining vault is empty, we stop eating at sit-down restaurants. It’s a hard stop that notifications can’t provide.

The Daily Cash Rule

If you are withdrawing cash, do not put it all in your wallet. Divide your cash by the number of days. Carry only today’s cash. If you want that vintage jacket—a trend Booking.com predicts 51% of travelers will embrace in 2025—you have to physically take cash from “tomorrow’s” envelope. The physical act of stealing from your future self is a powerful deterrent.

Handling the “Messy” Stuff: Currency & Conversions

Here is a technical trap that ruins expense tracking: The Home Currency Fallacy.

When you are in Thailand, do not track your spending in USD or GBP. Track it in Thai Baht. Why? Because exchange rates fluctuate. If you track in USD, you are guessing the conversion. If you track in Baht, you have an accurate record. Let the app handle the conversion rate math on the backend.

Post-Trip Analysis: The “Value” Audit

Tracking doesn’t end when you land. The most important step happens when you get home. You need to perform a Value Audit.

Look at your categories. Hilton’s 2025 Trends Report suggests we are in the era of the “Travel Maximizer,” where 70% of travelers want to be active. Does your spending reflect that?

If you spent $800 on dining but claim you care most about museums (where you spent $50), your budget is misaligned with your values. Use this data to adjust your next trip. Maybe next time, you book an apartment with a kitchen to slash the food budget and double the activity fund.

Interactive Tool: Daily Budget Calculator

Use this simple calculator to determine your safe daily spending limit after your fixed costs (flights/hotels) are paid.

Frequently Asked Questions

Does Splitwise work with multiple currencies?

Yes, Splitwise is excellent for multi-currency trips. You can add an expense in Euros, another in Yen, and settle up in USD. The app uses current market rates to convert the debt into a single currency for repayment.

What is the best free travel spending tracker?

For solo travelers, the free version of TravelSpend is robust enough for most needs. However, simply using a fintech banking app like Revolut or Wise is often better because it automates the tracking process entirely without manual input.

How do I track cash spending effectively?

Do not try to track every small cash purchase (like a $2 water). Instead, log the ATM withdrawal as a single expense (e.g., “Cash Allowance – $200”). Treat that money as “spent” the moment it leaves the ATM. This keeps your digital budget accurate without the headache of hoarding receipts.

How much should I budget for incidental travel costs in 2025?

With the rise of “skimpflation” and tourist taxes, experts recommend adding a 15-20% buffer to your expected daily costs. This covers unplanned city taxes (like Venice’s €5-€10 fee), increased ATM fees, and tipping.

Conclusion: Freedom Through Control

Tracking your travel spending sounds restrictive, but it is actually the ultimate freedom. When you know exactly how much you have spent, you remove the anxiety from the purchase. You can order that second glass of wine or book that impromptu snorkeling tour because you know the money is there.

The travel landscape of 2025—with its higher costs, new taxes, and digital-first economy—demands a smarter approach than a crumpled receipt in your pocket. Whether you choose the automation of Revolut, the discipline of TravelSpend, or the “Digital Envelope” method, the key is consistency.

Don’t let the finances overshadow the memories. Set your system up before you board the plane, and enjoy the trip knowing your bank account is safe.