How to build a smart travel budget?

How to Build a Smart Travel Budget in 2025 (Step-by-Step Guide & Calculator)

Let’s be honest: looking at flight prices recently feels a bit like a punch in the gut. You aren’t imagining it—travel sticker shock is real. According to the “Travel Costs Soar Report” released in April 2024 by Squaremouth, travelers are spending an average of nearly $10,000 on their trips this year—a staggering 7% increase over 2023.

If you plan your 2025 vacation using 2023 math, you’re going to run out of money before you even buy a souvenir. But here is the good news: Spending more doesn’t always mean getting less, provided you know how to allocate those funds.

In this guide, we are moving beyond generic advice like “skip the latte.” I’m going to show you the “Smart Luxury” framework—a method used by pros to beat inflation, leverage currency fluctuations, and maximize value. We will break down exactly how to build a travel budget that works in the current economic climate.

The “Smart” Budgeting Framework: Value Over Cost

The biggest mistake I see people make is starting with the question: “What is the cheapest way to do this?” In 2025, that approach leads to frustration. The better question, aligned with current trends, is “What is the experience worth?”

We are currently living in the “Experience Economy.” According to a May 2024 report by the Mastercard Economics Institute, spending on experiences now accounts for 12% of tourism sales, the highest point in at least five years. Tourists worldwide are even spending an extra day on vacation on average compared to pre-pandemic trends.

This means your budget shouldn’t just be a cage—it should be a roadmap to the things that matter. The framework below divides your budget into three buckets to ensure you prioritize memories over overhead.

Step 1: The “Big Three” Fixed Costs (50-60%)

These are the non-negotiables. In a smart travel budget, these consume roughly half of your total funds. If they creep higher, you’ll be eating convenience store sandwiches for dinner (unless, of course, that’s your vibe).

1. Airfare & Transportation Strategy

Flight prices are volatile. The key to budgeting here isn’t just guessing a number; it’s using the “Book Now, Travel Later” flexibility.

Budget Tip: Don’t budget for the average price. Track the flight for two weeks using tools like Google Flights or Hopper, then set your budget at the *current* average plus 10% to account for dynamic pricing.

2. Accommodation: The “Destination Dupe” Hack

Here is where you can save thousands. One of the hottest trends identified in Expedia Group’s “Unpack ’24” report is the rise of “Destination Dupes”—choosing lesser-known alternatives to major tourist hubs.

Travelers are looking for alternatives that offer the same vibe without the premium price tag. For example, Expedia search data shows massive spikes for Taipei (as an affordable alternative to Seoul) and Memphis (as an alternative to Nashville).

Case Study: A week in a 4-star hotel in Santorini in July might cost you $3,500. A similar standard hotel in Paros (a nearby island with better beaches) often averages 35-40% less. That is an instant $1,200 savings just by shifting your geography slightly.

3. Pre-Trip Essentials

Do not let these “hidden” costs surprise you two days before departure.

- Visas: Check entry fees (e.g., the ETIAS for Europe starting soon).

- Vaccinations: Travel clinics can cost $200+ per shot.

- Gear: Do you need a new adapter or carry-on bag?

Step 2: The Variable Daily Costs (30%)

This is where your budget lives or dies. Variable costs are slippery. To control them, we use the “Local Living” rule.

The “Local Living” Food Rule

Food is often the second largest expense. Matt Kepnes, known as Nomadic Matt, has long advocated for a blended approach to combat rising food costs.

The Strategy: Eat like a local, not a tourist. Budget for one nice meal out per day, and hit the local grocery store for breakfast and lunch.

Calculation: (Grocery Breakfast $5 + Grocery Lunch $10 + Restaurant Dinner $40) = $55/day per person.

Activities & Tours

Rick Steves, the European travel authority, offers a brilliant way to value your activities: break it down by the hour.

If a skip-the-line museum tour costs $40 but saves you 2 hours of standing in the sun, the ROI is massive. Budget for these “Must-Dos” in advance. Do not cheap out on the main reason you traveled in the first place.

Step 3: The “Invisible” Costs & Inflation Buffers (10-20%)

If you stop budgeting after flights, hotels, and food, you will go over budget. Guaranteed. In 2025, you must build a defensive wall around your money.

The 2025 Inflation Buffer

With the cost of travel rising 7% year-over-year according to Squaremouth, a simple contingency fund isn’t enough. You need an Inflation Buffer.

The Rule: Take your total estimated cost and add 15%.

Why? This covers currency fluctuations (if the dollar weakens against the Euro or Yen), unexpected city taxes, and the general “tourist inflation” that hits during peak season.

Travel Insurance: Is it Worth It?

Yes. In the post-pandemic era, travel disruptions are common. Squaremouth data highlights rising premiums, but also rising risks. If you cannot afford travel insurance, you cannot afford to travel. Budget approximately 5-7% of your total trip cost for a comprehensive policy.

Interactive Travel Budget Calculator

Use this tool to estimate your total trip cost based on the 2025 framework we just discussed. I’ve programmed in the 15% inflation buffer automatically.

Trip Fund Calculator

How to Fund Your Trip Without Debt

This is the most critical part of the guide. According to a April 2024 survey by Bankrate, 36% of travelers are willing to go into debt for their vacations. This is a financial trap.

Strategy: Points as a Line Item

Do not view credit card points as a “bonus.” View them as currency. Brian Kelly, The Points Guy, suggests treating points exactly like cash in your budget.

If you have 50,000 points worth $750, deduct that $750 from your “Cash Needed” total. This lowers the liquidity you need to save without lowering the quality of the trip.

The Sinking Fund Method

Once you have your number from the calculator above (let’s say $5,000), work backward.

Timeline: 6 Months

Monthly Save: $833

If you cannot save $833 a month, you cannot afford a $5,000 trip in 6 months. Push the trip to 12 months ($416/month) or adjust the itinerary.

Frequently Asked Questions

While highly dependent on destination, Gen Z travelers are currently spending an average of $11,766 per trip (Squaremouth data), though this often includes longer durations. For a standard 7-day international trip for two, a smart mid-range budget lands between $4,500 and $6,000 inclusive of flights.

What is the 50/30/20 rule for vacation saving?

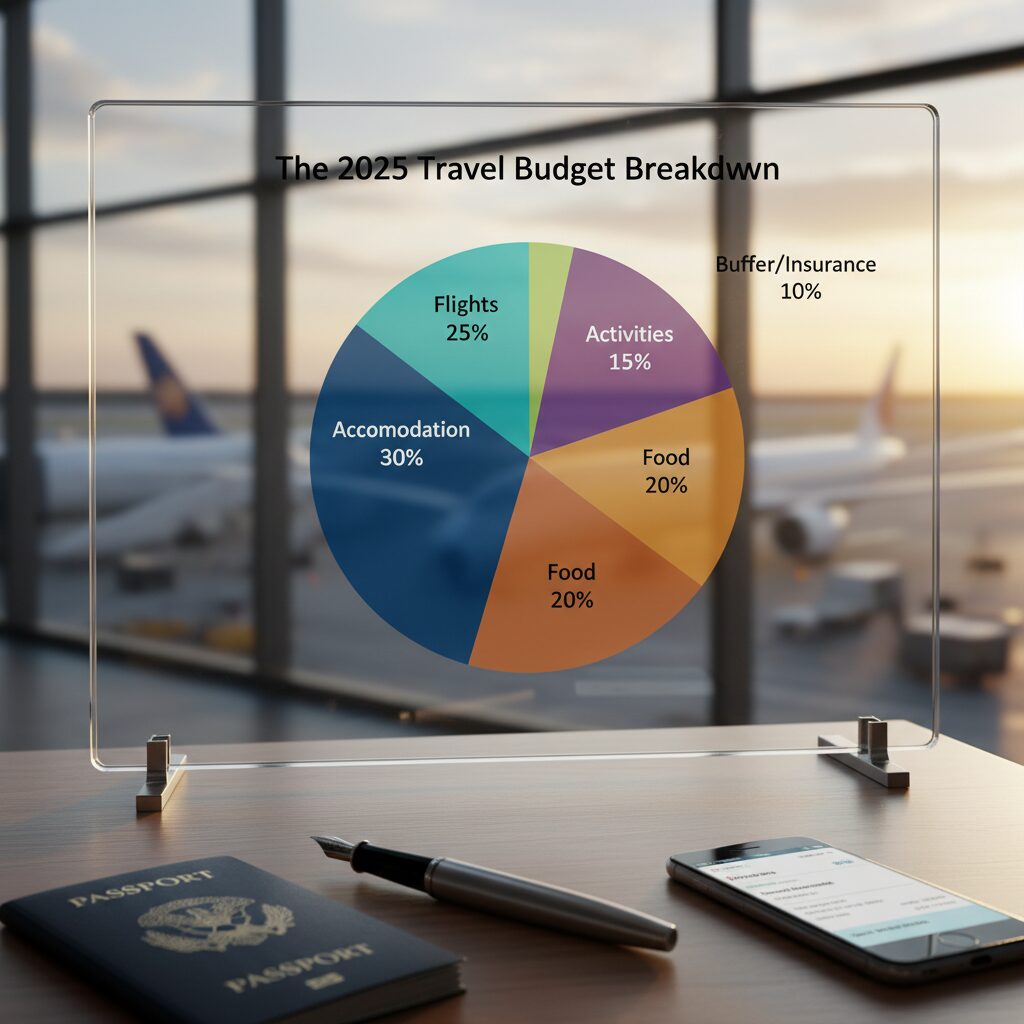

This rule usually applies to general finance, but for travel, we adapt it: 50% for fixed costs (flights/hotels), 30% for variable costs (food/fun), and 20% for buffer/insurance. If your fixed costs exceed 50%, you will feel “house poor” on your vacation.

Does a travel budget include shopping?

Technically, no. Your core travel budget covers existence and experience. Shopping is discretionary. Create a separate “Shopping Allowance” so that buying a leather jacket in Florence doesn’t mean you can’t afford dinner in Rome.

Conclusion: The Return on Investment

Building a smart travel budget isn’t about restriction; it’s about permission. When you know you have the funds—including that critical 15% buffer—you can say “yes” to the spontaneous wine tasting or the room upgrade without a spike of anxiety.

With costs up 7% and debt temptation high, the travelers who win in 2025 are the ones who plan with precision. Use the calculator, hunt for those “destination dupes,” and remember: the goal isn’t just to go, but to come back without a financial hangover.

Start your fund today. The world is waiting, and it’s worth every planned penny.